This post is part of a series of posts about the Economics of Urban Centers as illustrated within the context of global metrolpolis New York City. In this we will cover premium food, and how NYers choose it.

A. MARKET OVERVIEW

Dining is considered an essential fabric of urban centers. Food in the 21st century is part of lifestyle, an experience, a city attraction and eventually big business. These dayts urban planners have to create a variety of dining options to attract professionals and commercial activity in a city. Food operators have to go the extra mile and offer uniqueness celebrated in the likes of art, to the high end consumer. And the consumer has to eventually shell out more for all of this.

Food has become part of the individual’s identity a statement same as clothing, housing, cars (just to remember French philosopher and sociologist Bourdieu). For example there’s green, biological, vegan, vegetarian, ethnic cuisine. Food producers provide information on whether protected origin, photos of people producing the food, whether renewable energy used in production or other environmentally friendly process, whether handpicked or other. They stay in touch and interact with consumers online.

NYers take pride in having one of the best dining options around the world in terms of variety and quality. The total value of the New York food industry is around $ 19 billion (US Census) and covers a large number of companies and flavors. It is also one of the big income earners for municipal and state coffers and a big employer that caters for the millions of residents and tourists.

On the other hand, considering the cosmopolitan character the population increase, high incomes and many tourists it’s not strange that there’s so much interest in investing both from domestic and international investors and businesses. Operating here can offer apart from significant return in its own right, visibility across the US and world and hence brand projection and as springboard for expansion.

Below we provide some basic information for aspiring market participants, this is not a complete market study, while we are open to discuss further.

- Large size: total population of the extended NYC metro area is estimated at 20 million. New York has the highest population density in the US. Manhattan’s population at around 2 million more than doubles during the day with the influx of work commuters, visitors and tourists. NYC boasts some of the highest family incomes. Outside locals tourists are estimated at 52 million with an average spending of $ 700 ($37bn total influx).

- The bigger picture: The American food industry in total is a $1.1 trn market of which retail food (at home) accounts for $650 bn and foodservice (away from home food) for $ 450 billion of which fast food is $ 184 bn. Sales of specialty food is estimated at $70 nm and or organic food at $30 bn growing at high rates. New York City because of its position as probably the largest business center in the world is the necessary point of presence for global brands. Often NYC, with its international population and tourism serves as testing ground for many ideas and creates trends. Although the overall food market is mature, there is potential for explosive growth in sub-sectors as evidenced by the meteoric rise of Greek yogurt much of which started in NYC. It’s not uncommon for tourist to visit certain stores they’ve seen in movies, (for example the Boathouse or the Serendipity or to try products made famous here like the cronut or the cupcake). You may refer to our earlier post in this series regarding NYC’s redevelopment into an attractive investment destination and a consumer mega-center here: NYC Urbanomics Part 1: NYC Redevelopment, a template for urban renaissance and commercial boom.

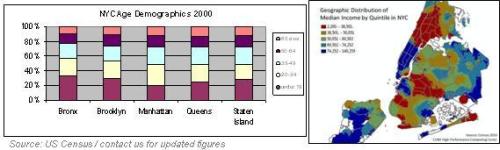

- Demographics: New York City has a strong international/cosmopolitan character. One in three New Yorkers are foreign-born. Nearly 400,000 millionaires live in New York, mostly Manhattan. Each borough has a different character with Manhattan being the more affluent and the big corporate, retail and tourist center. There’s a higher percentage of prime age professionals (20-50) in Manhattan compared to the boroughs and lower percentage of children. Families and small businesses are more common in the outer boroughs and incomes are generally lower there. However real estate prices have recently been increasing in Brooklyn and Queens even there (Long Island City). Much of these increases have been due to gentrification and population inflow mainly from foreigners but as well Americans especially the young that have stormed the Brooklyn All that is important in selecting the locations that are a good fit for a particular concept and then estimate traffic and consumption.

- Spending Patterns: The average household income in most of Manhattan exceeds $100,000 (some of the richest areas in all America) with 12.4 % of that spent on food. In the other boroughs average family income is much lower (the poorest receive food aid). Manhattan residents, where the center of the dining industry, have high educational level and are very sensitive to service quality and healthy, biological and gourmet aspects of food. New Yorkers are characterized by lack of time and small household size factors that favor fast food consumption (40 % of Americans eat 4 times a day) with snacking being more common among the younger. The majority of Manhattan residents are actually single. On top of that one has to appreciate the huge spending by the more than $50 million tourists, much of which goes to food. With so many commuters and tourists flocking the streets what’s more natural than a quick snack, especially with all the so many intriguing options? Manhattan is becoming a sort of an urban theme park, a Disneyland for the well off and the many tourists. All these factors create an ideal environment for food away from home.

- Food retail – Competition: NY is characterized by the absence of large national grocery chains (ie WalMart). The market is fragmented, there’s a large number of establishments divided between supermarket chains, convenience store, discount stores and specialty store. Supermarket chains are upscale, mainly in Manhattan such as Whole Foods, Food Emporium, D’Agostino or more affordable/middle class in the suburbs. Real estate in NYC is expensive. That means that supermarkets are smaller and more cramped compared to those in the suburbs. It also means that shelf space is costly which sets the bar high for product sales. Trader Joe’s, the fast moving product chain, that is also present in Manhattan, has nationwide an average estimated revenue per square foot of $1,750 in 2010, more than double that for Whole Foods (Inside the secret world of Trader Joe’s). Prices can be high but upscale consumers have as well high expectations from product quality and branding. There are also many specialty stores (ethnic, deli, organic etc) where prices and margins are higher but they have to make up for lower volumes too. Outside that, for many busy NYers small specialty and convenience stores are the grocery stores of choice. Many ethnic stores in the boroughs cater to immigrants communities within which they are located and to their spending power. Discount stores (like family dollar) serve lower income consumers; although prices there are low, profit margins are significant.

- Foodservice — Competition: establishments are divided into fast food, fast casual, casual dining and fine dining. The market is fragmented as well. There is a large number of establishments with most of restaurants being independent and to a much lesser extent franchised/multi establishment. Apart from the large number of fine restaurants and celebrity chefs, mainly in Manhattan, NYC also offers all other options, from international cuisine, diners, ethnic food and very common street food (food trucks).

- Foodservice segmentation: There’s everything in NYC, something for everybody. If NYC doesn’t have it, then probably you don’t want it, or maybe it’ll not going to be long until it has it…! Here are the main dining categories:

- Casual and fine dining: Virtually all types of cuisine are available in good supply. Outside typical cuisines and styles (French, Chinese, Italian, American etc) variety extends to hybrids, for example vegan sushi and other; it’s up to innovation. Apart from being distinguished based on type of cuisine, establishment are also classified according to character/setup such as lounges, bistros, brasseries, gastropubs, etc A foodie paradise!

- Fast food and Fast casual (both not offering full table service but the second being more expensive with upscale/unique design and most of food prepared in the store): The New York City fast food sector includes chains selling the traditional burgers (along traditional ones new specialty are gaining popularity: Bareburger, Five Guys), chicken (KFC), sandwich (Subway), international such as Mexican (Chipotle, Taco Bell), Asian(noodle) and other ethnic options, Bakery/Coffee (ie Panera, Starbucks), Pizza (Papa John’s, Domino’s) and other specialty stores (for example salad (Chop’t), seafood (Red Lobster) etc). The most popular type of fast food is the burger, followed by sandwiches and chicken. The fast casual niche is very promising especially in NYC. It generates $21−22 bn nationally and is not only growing fast but also setting trends. It’s more suitable for today’s consumer character same as original fast food chains revolutionized the industry in the 20th Lately even McDonald’s said it will allow customization.

- Foodmarkets: These are new arrivals to the NYC scene. They are very large stores that combine multiple restaurants and groceries usually centered around a theme. Eataly was the first one, offering all sorts of Italian products and cuisines, capitalizing on famous chef’s Mario Batali reputation and TV persona. It is very successful although the high investment. It has since expanded in other cities and locations. What’s interesting for Eataly is that it promoted the Italian culture through its store and eventually Italy as a destination. It is to be followed by a French themed foodmarket called Le District of the Poulakakos group, in the lower tip of Manhattan. There are other such projects discussed or coming such as European themed Hudson Market and a global themed one discussed by famous chef and TV persona Bourdain.

- Consumer profile: High end consumers in NYC are more interested in service, décor and experience; in fact maybe more than food. According to certain surveys this is a general trend. As René Redzepi, the much celebrated Danish Michelin awarded chef puts it: “Our main mission at the restaurant and what I tell the staff when they leave here is, give your guests a sense of time and place. Whether it’s the product range, which is a big part of us, but also the whole atmosphere, the way that the restaurant is set. That’s how we give our guests a sense of time and place”. A Nielsen survey regarding wine consumer profiles’ is very revealing in this respect: almost half of wine sales are performed by wine enthusiast and image seekers that perceive the product as sort of a hobby or projection of them selves. They spend a lot of time on research and to get educated on the product so the retailers have to cater by providing variety, good service and information. Off course price is not their main concern. Uniqueness, customization is key.

B. INVESTMENT PARAMETERS

Given that there’s significant interest for investment in the NYC food sector lately we present below some basic information useful in evaluating the feasibility of such an endeavor. There’s no doubt that operating in New York City offers many benefits in terms of return and visibility but at the same time the capital required is significant and so are the risks. Hence a very careful evaluation is necessary. You may also refer to our earlier post in this series regarding NYC’s redevelopment into an attractive investment destination and a consumer mega-center here: NYC Urbanomics Part 1: NYC Redevelopment, a template for urban renaissance and commercial boom.

The information below is only indicative based research we have carried out for international chains and importers of upscale foods and opportunity evaluation regarding expansion in the NYC area. We are able to discuss in more detail with investors and operators the feasibility of their ideas, entry barriers, get-to-market approach, business plan, operating, labor and tax issues, marketing plan and provide consulting services in this respect. We also have successful operating concepts to present to investors as well as proposals for greenfield developments.

- Concept: As mentioned before upscale consumers are all about character and information, so customization is the name of the game. Fast casual chains offer this possibility (Bareburger, Chipotle etc) as well as premium service. It doesn’t hurt as well to center everything around an environmental/socially sensitive aspect something quite important for the millenials. There are various ways to create product differentiation for upscale pricing but let us keep this for our clients. On the other hand there are opportunities in the lower end of the market just as long keeps limitations into perspective.

- Location: Manhattan or certain areas in Brooklyn and maybe Queens offer the highest incomes and favorable traffic and consumption patters. The location depends on the type of concept vs the area’s demographics, ie whether it’s more appealing to young or professionals or families. Traffic also depends on location and whether this is a location with 24 hour traffic, business center with lunch snacking or nightlife spot. Rents will also be higher for busy areas except if somebody is able to be ahead of the curve although the market has pretty much priced in these days future gentrification, subway expansion, new office and commercial development etc. Although vacancy rates are low there is new store development as well. Furthermore supply can be crated from a large number of expiration of old leases or stores closing to make way to new concepts. A good real estate agent and lawyer can help a lot in this respect.

Financial Parameters:

- Sales targets: McDonald’s still sets the standard in fast food. It has one of the highest sales per store at $2.6 million and successful fast casual chains are not far from that (Panera, $2,3m, Chipotle at $2,1m at 2012). Sandwich, coffee and pizza stores are lower than that. Fine dining/small restaurants will have to aim for as high as $100 per person or higher while lower margin establishments survive on the high traffic/low price concept. Regarding food import/wholesale we have already noted high shelf cost for retailers something that calls for low risk products ie products with brand awareness (ie marketing support), sales rep expenses and off course administrative and distribution.

- The rent can be as high as over $100-150/ft per year in Manhattan and moving towards these directions in popular, up and coming locations in the boroughs, although generally lower there. By comparison average retail rent sought in Manhattan in spring 2013 was $116/sq.ft but in prime locations can go well into four digits (Street’s Sunny Side Costs Retailers More in Rent)

- Wages: The minimum NYC wage is $8.75 per hour (end of 2014) and to be raised to $9 but wages can be higher depending on experience. National accommodation and food industry wages are about $13 an hour on average for all employees and $11.50 for nonsupervisory employees (Six industries that can’t find workers fast enough) There’s ample labor supply in NYC although unemployment is getting low so good workers have options. There’s also a large number of undocumented immigrants working in the food sector in NYC; that’s a common secret. Healthcare insurance may be avoided if small business, but other business insurance is advised in a very litigious environment.

- People: Taking into consideration the level of sophistication and competition as well as the lofty economic parameters it’s not strange that stakes are high in the NYC food sector. NYC retailers and restaurateurs have to invent ways to persuade their customer about their distinctive experience something that will justify higher prices. Yes there are new trends, new diets, molecular gastronomy, and other tantalizing tastes but in the end who cares about food? Who wants to eat after all? Actually people are trying hard not to eat and limit calorie intake. But they care about other issues such as the atmosphere, the concept. There’s a large number of professional going into the product that may have nothing with food, for example architects, designers, concept consultants, marketers, digital/social media professionals not to mention dieticians, food safety and productions experts and other. Customer analytics and other marketing tools are important in analyzing client profiles. As a result more money goes on sales & general expenses, what’s called customer acquisition, rather than product cost. No misunderstanding, quality has to be there, this is a common denominator, a prerequisite. But it’s the branding that feeds into the mind of the self-actualized consumer. So the money to buy so many brains is important. See for example the level of expenses going into design vs production for luxury products. This level of professionalism and investment is often mind-blowing for traditional operators. In some occasions however some of the operators are able to realize trends and come up with fresh concepts on their own (for example Bareburger).

- Regulations: Establishments have to comply with local food safety regulations and the NYC environment can be unforgiving due to humidity and large number of rodents. Food importers have to check for import quotas and other limitations. Trading and selling alcoholic drinks require special licensing. There are also zoning regulations regarding permitted commercial activities in a specific area as well as construction costs and procedures that have to be taken into consideration in the case of new endeavors, which can be lengthy. Setting up a legal entity is quite straightforward though.

Let us know about questions. We are happy to discuss your project or to present proven business concepts to invest (as franchisee or shareholders) or proposals for new projects.

——————————-

This post is part of a series of posts about the Economics of Urban Centers as illustrated within the context of global metrolpolis New York City. In this we cover premium food, and how NYers choose it. You may refer to our earlier post in this series regarding NYC’s redevelopment and how it manage to take distance from a past of urban decline and turn into a consumer mega-center here: NYC Urbanomics Part 1: NYC Redevelopment, a template for urban renaissance and commercial boom. In this post we also present some of the reasons NYC is an attractive investment destination as well as of the consumer profile there.

——————————-

By Pete Chatziplis, CFA, ACCA, MBA. The articles published here do not necessarily reflect the views of the Transatlantic Business Forum. For more information on our consulting services please refer to our website at Transatlantic Business Forum..

—————–